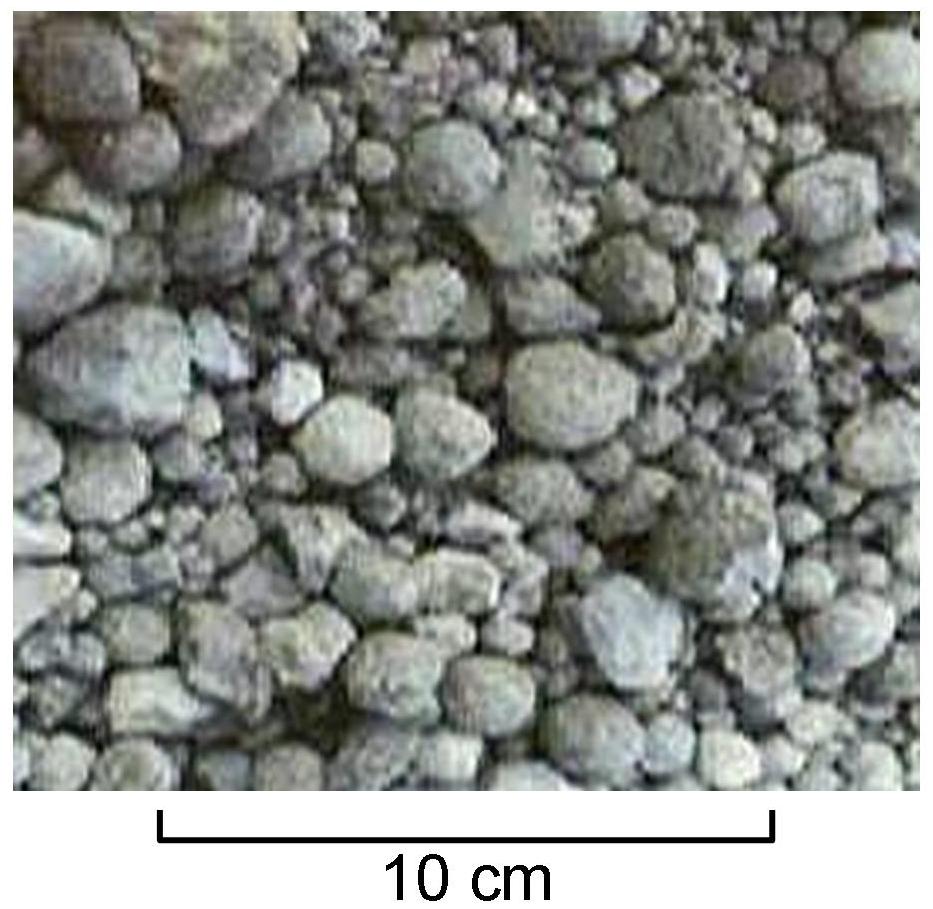

Picture credit: Gavin Houtheusen/Department for International Development, Factory of National Cement Share Company, CC BY 3.0

Each year, more than half of the estimated 62 million tonnes of municipal solid waste generated in India is thrown at various dumpsites. At this rate, India will require a landfill area of 8,800 hectares in 2050 – equivalent to the size of New Delhi city – according to the World Business Council for Sustainable Development (WBCSD).

By using 25 per cent Alternative Fuels and Raw materials (AFR) in 2050, India’s cement industry can contribute as much as 26 per cent reduction in the space required for landfilling. Clearly, the potential is enormous.

Solidwasteindia.com speaks to Ms Aparna Dutt Sharma, Secretary General, Cement Manufacturers Association (CMA) on some of the challenges faced by the cement industry in using Refuse Derived Fuel (RDF) as the preferred source of alternative fuel.

1. How many cement plants currently exist in India?

There are about 85 cement companies operational in the country. Our Association – the Cement Manufacturers Association – represents about 90 per cent of the installed cement capacity in India. It may be mentioned here that almost 70 per cent of installed cement capacity in the country is represented by 20 companies.

2. In most countries this industry is highly concentrated. In India, how many companies are active in this business?

The Indian cement industry is the second largest in the world after China. It is among the eight core industries in India essential for the economic growth and development of the country. There are approximately 263 cement plants in India representing a cumulative installed capacity of 532 million tonnes (2017-18). These plants include integrated plants, clinkerisation units, grinding units and blending units. Pending published data and based on media reports, we could expect the installed cement capacity in India to be around 550 million tonnes in 2018-19.

3. How many of these plants produce clinker, and therefore have a rotary kiln?

Out of the total 263 cement plants in India, 165 are clinker producing units, comprising both clinkerisation and integrated units.

4. The Government of India’s Swachh Bharat Mission mandates the use of alternative fuels and raw materials (AFR) in the cement industry. How many of the cement factories use waste sources in the combustion process?

In India, more than 60 cement plants have reported continual use of alternative fuels in the combustion process. This data is provided by a 2018 report of the World Business Council for Sustainable Development (WBCSD).

5. How high is the share of fuel input per plant?

The average share of fuel input varies from plant to plant depending upon the limestone quality and availability of good quality waste. The average thermal substitution rate (TSR) represented by the Indian Cement Industry is close to 4 per cent.

RDF received by the industry does not adhere to these parameters, which poses significant operational, technical and financial challenges for the industry.

Aparna Dutt Sharma, General Secretary, Cement Manufacturers Association

6. RDF offers tremendous opportunity to enhance the thermal substitution rate (TSR) of cement kilns in the country. In India, what are the main waste streams that are used for producing RDF for cement kilns?

RDF is derived from municipal solid waste (MSW), which includes material that is combustible in nature but not suitable for recycling due to its physical/chemical properties. This predominantly includes soiled paper, soiled cloth, contaminated plastics, multilayer, packaging materials, other packaging materials, pieces of leather, rubber, tyres, and wood etc. These wastes must be appropriately treated and pre-processed by the generators and/or aggregators before it can be disposed of by the cement industry. In any case, RDF must find its way as the best alternative to mainstream fuel through suitable incentives and adequate implementation of the Polluters Pays principle.

7. Do the cement kilns pay for the RDF or get money because they burn it?

These are business decisions for which you may approach cement companies.

8. What is the average price?

Due to the Competition Commission restraint order, CMA does not collect or maintain data on prices.

9. What is the average calorific value of the RDF generated from MSW in India?

The cement industry prefers RDF Grade 1 and Grade 2 of net calorific value greater than 3,750 kcal/kg. Besides, there are certain minimum quality parameters that need to be considered along with specific size specifications. Generally speaking, it is noticed that the RDF received by the industry does not adhere to these parameters, which poses significant operational, technical and financial challenges for the industry.

10. Could you please elaborate on these specific challenges?

The main problems faced by the cement industry include high moisture content in RDF (greater than 15 per cent), which has a negative effect on the specific heat consumption thereby adversely impacting the cement kilns. Additionally, high chloride levels in RDF impact clinker quality leading to material build up in the kiln inlet and preheater cyclone causing kiln stoppages and loss of production. Further, a high percentage of heavy metals in RDF is detrimental to kiln operations and leads to energy inefficiency. Moreover, ash also leads to increased heat consumption as well as production loss.

11. How are you addressing these issues so that the cement industry is encouraged to increase its use of MSW-generated RDF?

Recently we were partners to the Government of India in the Swachhata Hi Seva campaign, which ran over Sep-Oct 2019. There are some obvious learnings, which have come to the fore subsequent to the experience. The essential point is that for any initiative to succeed, it is important that players and institutions involved in the initiative appreciate each other’s roles and be fully equipped to deliver on those. Clearly, the Polluter Pays Principle is integral for large scale and efficient waste management.

Segregation begins with individual households. At the municipal level, capacity building and skill sets for appropriate collection, treatment and pre-processing are much needed to facilitate RDF. The cement industry can eventually evaluate the disposal of waste depending upon its quality and quantity. It is sometimes simplistically understood that all waste can be disposed by the cement industry. This is a misnomer and needs to be corrected. Cement manufacturing is a complex process, which calls for sustained balancing and maintaining certain chemistry within all elements that go into the making of cement. For cement plants to be able to use waste there are costs involved in plant and machinery. It is a combination of various factors including requisite policy support that could probably help the cement industry enhance its thermal substitution rate.

This interview is part of a special series showcasing important stakeholders in India’s solid waste management sector. Watch this space for more in-depth conversations, views and analysis.